Introduction: Managing the SME Tax Debt Burden

As of 1 July 2025, Australian small and medium enterprises (SMEs) face a new financial challenge: interest charges on Australian Taxation Office (ATO) tax debts, including the General Interest Charge (GIC) and Shortfall Interest Charge (SIC), will no longer be tax-deductible. This change, outlined by the ATO (ATO Interest Charges), means SMEs relying on ATO payment plans will encounter mounting ATO interest liabilities, exacerbating cash flow issues. At Professional Home Loans, we understand the SME tax debt burden and offer tailored solutions, including business loans for ATO debt Australia, to help you manage and pay off tax debts efficiently. This blog explores the impact of ATO interest charges non-deductible and provides SME cash flow solutions to avoid penalties.

Understanding ATO Interest Charges Non-Deductible in 2025

From 1 July 2025, the ATO’s new rule eliminates tax deductions for GIC and SIC on tax debts. Previously, SMEs could offset these costs—GIC for late payments and SIC for underpaid tax estimates—against taxable income. Now, ATO interest charges non-deductible in 2025 hit your bottom line directly. According to the ATO (ATO Payment Options), this encourages timely compliance but challenges SMEs with limited reserves. Key impacts include:

- Mounting ATO Interest Liabilities for SMEs: GIC rates, often exceeding 10%, can escalate quickly, creating a significant SME tax debt burden in 2025.

- Cash Flow Pressure: Non-deductible interest strains budgets, limiting funds for operations or growth.

SME owners must act swiftly to manage ATO debt under these new rules to avoid spiraling costs.

The SME Tax Debt Burden: Why It Matters

The removal of tax deductibility for ATO interest charges amplifies the SME tax debt burden in 2025. For example, a $50,000 tax debt at an 11% GIC rate incurs over $5,500 in annual interest—now a non-deductible expense. This cost can disrupt SME cash flow solutions, delay investments, or force layoffs. The table below illustrates the real cost of ATO interest charges non-deductible in 2025 across different debt levels, assuming a 30% tax rate for previous deductions:

| Tax Debt | Annual Interest (11%) | Previous Real Cost* | New Real Cost | Extra Cost |

|---|---|---|---|---|

| $30,000 | $3,300 | $2,310 | $3,300 | $990 |

| $50,000 | $5,500 | $3,850 | $5,500 | $1,650 |

| $80,000 | $8,800 | $6,160 | $8,800 | $2,640 |

*Assuming 30% tax rate

Common challenges include:

- Deferred Payments: SMEs using ATO payment plans for BAS or PAYG face higher costs as non-deductible interest accumulates.

- Penalty Risks: Unpaid debts trigger further ATO penalties, worsening the financial strain.

The Australian Small Business and Family Enterprise Ombudsman (ASBFEO) notes that tax debt is a growing concern for SMEs, making proactive management critical to avoid mounting ATO interest liabilities.

SME Cash Flow Solutions: Managing ATO Debt

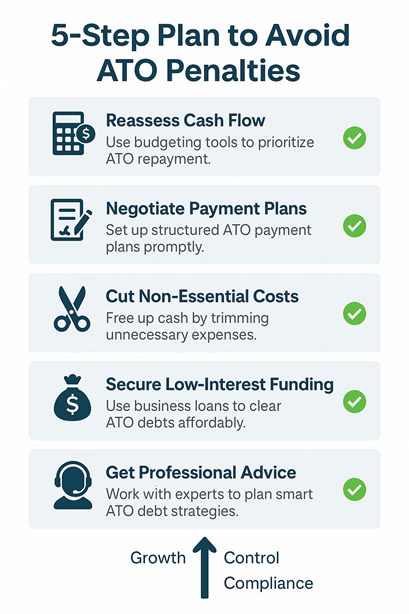

Effective cash flow management is essential to tackle ATO interest charges non-deductible in 2025. Here are SME cash flow solutions to reduce the tax debt burden:

- Reassess Cash Flow Strategies for SMEs with Tax Debt

Prioritize tax payments by reviewing your budget. Tools like Xero help forecast cash flow, ensuring funds for ATO debt repayment.

- Reassess Cash Flow Strategies for SMEs with Tax Debt

- Negotiate ATO Payment Plans for Small Businesses 2025

ATO payment plans spread tax debt over time. Apply via ATO Payment Options, but note that non-deductible interest still applies, so clear debts quickly.

- Negotiate ATO Payment Plans for Small Businesses 2025

- Reduce Costs

Cut non-essential expenses (e.g., subscriptions) to free up cash for ATO debt, minimizing mounting ATO interest liabilities.

- Reduce Costs

These strategies help, but many SMEs need additional support to manage the SME tax debt burden in 2025.

SME Tax Debt Financing Options: Alternative Funding

For SMEs struggling with cash flow, alternative funding can clear ATO debts and avoid penalties. Business loans for ATO debt Australia are often a cheaper, tax-deductible alternative to ATO interest. The table below compares ATO GIC interest to business loans:

| Cost Type | ATO GIC Interest | Business Loan |

|---|---|---|

| Annual Interest Rate | 10–11% (variable) | From 6–9% (fixed) |

| Tax Deductible |  No No |  Yes Yes |

| Compounding Interest |  Yes Yes |  No No |

| Risk of Penalties |  High High |  Low Low |

Business loans can be a cheaper, deductible, and more stable alternative to ATO debt. Here are top SME tax debt financing options for 2025:

- Business Loans for ATO Debt Australia

A business loan can settle ATO debts in full, stopping high GIC/SIC costs. Professional Home Loans offers tailored business loans for ATO debt Australia, with competitive rates. Contact us to explore.

- Business Loans for ATO Debt Australia

- Low-Interest Loans for SME Tax Debt

Seek loans with rates lower than the ATO’s 10-11%+ GIC. Our SME loan solutions at Professional Home Loans save you money long-term.

- Low-Interest Loans for SME Tax Debt

- Business Financing for ATO Payment Plans

Use financing to cover ATO payment plan costs, preserving cash flow. Lenders like Prospa offer fast SME funding—check their eligibility online.

- Business Financing for ATO Payment Plans

- Unsecured SME Loans for ATO Debt

Unsecured loans provide quick access to funds without collateral, ideal for urgent tax debt repayment.

- Unsecured SME Loans for ATO Debt

These options help SMEs avoid ATO penalties and stabilize cash flow. Visit Business.gov.au for more tax debt financing tips.

ATO Debt Solutions for SMEs: Avoiding Penalties

Proactive steps can minimize the impact of ATO interest charges non-deductible:

- Pay Early: Clear tax debts before 1 July 2025 to limit GIC/SIC exposure.

- Seek Expert Advice: Consult an accountant via CPA Australia to optimize ATO debt solutions for SMEs.

- Secure SME Tax Debt Financing Options 2025: Use business loans for ATO debt Australia to settle balances fast, avoiding high interest costs.

At Professional Home Loans, we specialize in low-interest loans for SME tax debt 2025, helping you navigate the SME tax debt burden.

Conclusion: Take Control with SME Cash Flow Solutions

The ATO’s decision to make interest charges non-deductible from 1 July 2025 creates a significant SME tax debt burden. Mounting ATO interest liabilities threaten cash flow, but proactive steps—reassessing budgets, negotiating ATO payment plans for small businesses, and securing business loans for ATO debt Australia—offer relief. At Professional Home Loans, we specialize in SME tax debt financing options, as shown below:

Professional Home Loans: Strategic SME Solutions

✓ Business loans: $20,000 – $500,000

✓ Unsecured options: No asset security required

✓ Rapid execution: Approvals in 24-48 hours

✓ Fixed-rate certainty: Lock in today’s rates

Take Action Now: Don’t let ATO debt derail your business. Apply for business loans for ATO debt Australia with Professional Home Loans today to clear your tax debt and secure your financial future. Get Started with Your SME Loan Solution or contact our team for personalized ATO debt solutions for SMEs. For additional guidance, explore ATO’s Support for Businesses.

Book in for a Strategy Session to see how we can assist.

Additional Resources

- ATO Interest and Penalties: Understand General Interest Charge (GIC) and Shortfall Interest Charge (SIC) rules, including remission options for SMEs.

- Business.gov.au – Taxation: Australian government hub offering tax management tips and support for SMEs navigating tax debts.

- Small Business Development Corporation – ATO Tax Debt Guide: Practical advice for SMEs on engaging with the ATO to manage tax debts effectively.

- Tax Debt Solutions – ATO Debt Forgiveness Guide: Insights on ATO debt release options and strategies for SMEs facing financial hardship.