FREE REPORT REVEALS…

The Home Loan Fees Banks Are Willing To Waive For Professionals And How Asking A Simple Question Could Save You Up To $40,000

Miss one of the key steps in this report and your finance application may remain stuck in a tray at the bank… In this report, you will learn…

- Why lenders will waive some fees based on your occupation

- How to save up to $40,000 with a single question

Free Report: Fill in the form for free instant access…

FREE REPORT

Get instant access to the free report: “The Professional’s Guide to Financing Australian Property”

"*" indicates required fields

- We respect your privacy

Australian Professionals living and working in Australia can now buy their home or investment property with the advantage of preferential interest rates and the waiver of Lenders Mortgage Insurance.

But not all mortgage brokers have access to these policies with such valuable benefits, and those that do are notorious for making the information you need hard to access.

“Discover the special benefits lenders reserve for professionals – including two full case studies.”

Our special report, The Professional’s Guide to Financing Australian Property, will help you navigate the minefield of obtaining an LMI waivered mortgage. You’ll find money saving advice and tips including:

- Why some lenders will waive your LMI premiums (Page 4)

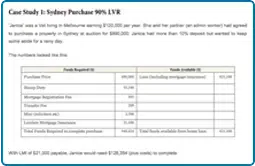

- Two case studies demonstrating the massive cost savings achievable through these policies (Page 5 & 6)

- How to ensure your credit file remains clean (Page 8)

- Why you have to take care with pre-approval from a bank staff, and how to receive a “Fully approved and verified finance pre-approval” (Page 8)

- And more…

Download your copy of our Free Report today and discover how to navigate the process of financing property, and accessing the discounts available to you as a professional. A few minutes spent reading this report will save you a ton of time and money, as well as cut out that long term frustration of making the wrong decision. You can also check our free finance report here for more specific need.

To find out more about the exclusive benefits some lenders reserve for professionals, download the Free Report today

I look forward to helping you.

Regards

Principal, Professional Home Loans

“Australia’s Experts in Financing The Best Premium For Professionals”

Getting a home loan was really simple with Professional Home Loans.

“We went overseas during settlement and it was not a problem for them, everything went smoothly and I’m writing this from my new home! “

Jack Clancy

Physio

Well done you made it easy with no BS.

“Couldn’t ask for a better job – until next time (although no time soon, moving was awful). “

Accountant, Mick and Vanessa Renton

90% no LMI Brisbane, QLD.

No LMI for building home in Sydney as well as 90% LVR no lmi for investment proerpty off the plan in Newcastle.

“Professional Home Loans has provided us with a very professional service, communicating all the available options to us and in the process he has literally saved us $75k that we would have otherwise paid. They certainly go beyond the call of duty. “

Hamilton (Accountant) & Nyari (Doctor) Sydney

NSW

Working for QLD Health achieved 90% LVR no LMI at normal rates - From UK. Sunshine Coast, QLD

“We were able to get a loan at a good rate and avoid paying LMI which saved us several thousand dollars that we can now put towards other things. Very helpful and informative about all aspects of the process, not just the loan, which we really appreciated as it made the whole thing a lot easier for us.”

Craig and Louise (Medical Registrars)

Sunshine Coast QLD