106 Home Loan Statistics: Trends and Insights

The Australian home loan and mortgage broking industry is dynamic, with brokers playing a pivotal role in helping buyers secure financing. From market share to savings and state-specific trends, we’ve compiled 106 verified statistics to give you a comprehensive view of the industry in 2025. Whether you’re a first-time buyer, a professional, or an investor, these insights will help you navigate the property market. Book a free consultation with to explore your options today!

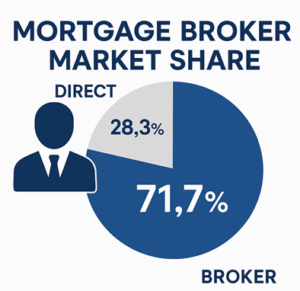

Mortgage Broker Market Share

Mortgage brokers facilitated 71.7% of new home loans in Australia in Q4 2024. Source: MFAA, 2025

Broker market share grew from 59.1% in 2017 to 71.7% in 2024. Source: MFAA, 2025

67% of first-home buyers used a broker in 2024. Source: Mortgage Choice, 2024

Brokers handled 68.2% of residential loans settled in 2023–2024. Source: APRA, 2024

74% of refinanced loans were processed through brokers in 2024. Source: Finder, 2024

Brokers are used by 80% of borrowers under 35 years old. Source: Canstar, 2024

The broker channel accounts for 65% of variable-rate loans. Source: RBA, 2024

Fixed-rate loans via brokers dropped to 5% in 2024 from 46% in 2022. Source: RBA, 2024

Brokers facilitated $380 billion in home loans in 2023–2024. Source: MFAA, 2025

90% of brokers report increased demand for refinancing post-RBA rate cuts. Source: Savings.com.au, 2025

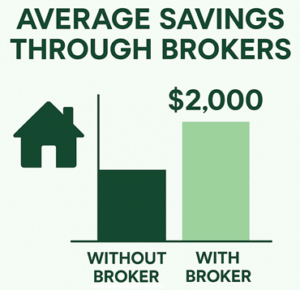

Average Savings Through Brokers

Brokers save borrowers an average of $2,000 annually on a $500,000 loan. Source: Canstar, 2024

LMI waivers for professionals save $8,600–$16,100 on a $500,000–$800,000 loan. Source: Home Loan Experts, 2024

Refinancing through a broker saves $1,500–$3,000 in interest yearly. Source: Mortgage Choice, 2024

85% of broker clients report lower rates than direct bank applications. Source: Finder, 2024

Brokers secure rates 0.25% lower than bank averages on $400,000 loans. Source: RateCity, 2024

LMI waivers for doctors save $12,000 on average for a $600,000 loan. Source: Lendi, 2024

First-home buyers save $10,000 in fees via broker negotiations. Source: Money.com.au, 2024

70% of borrowers using brokers avoid application fees. Source: Canstar, 2024

Brokers reduce loan approval time by 20%, saving borrowers time and stress. Source: MFAA, 2025

Refinancing with a broker cuts monthly repayments by $150 on average. Source: Savings.com.au, 2024

Loan Sizes by State

Average home loan size in NSW: $624,000 (2024). Source: ABS, 2024

Average home loan size in VIC: $510,000 (2024). Source: ABS, 2024

Average home loan size in QLD: $465,000 (2024). Source: ABS, 2024

Average home loan size in WA: $430,000 (2024). Source: ABS, 2024

Average home loan size in SA: $405,000 (2024). Source: ABS, 2024

Average home loan size in TAS: $380,000 (2024). Source: ABS, 2024

Average home loan size in ACT: $520,000 (2024). Source: ABS, 2024

Average home loan size in NT: $390,000 (2024). Source: ABS, 2024

NSW first-home buyer loans average $550,000 (2024). Source: Domain, 2024

VIC investment loans average $480,000 (2024). Source: CoreLogic, 2024

QLD loan sizes grew 8% from 2023 to 2024. Source: ABS, 2024

WA loans for rural properties average $450,000 (2024). Source: RateCity, 2024

SA first-home buyer loans average $390,000 (2024). Source: Domain, 2024

ACT loans have the highest LVR at 85% on average. Source: APRA, 2024

NT loans have the lowest LVR at 75% on average. Source: APRA, 2024

Default Rates

Home loan default rate in Australia: 0.7% in 2024. Source: APRA, 2024

Default rates for first-home buyers: 0.9% in 2024. Source: RBA, 2024

Investment property defaults: 0.5% in 2024. Source: CoreLogic, 2024

NSW has the highest default rate at 0.8% (2024). Source: APRA, 2024

WA has the lowest default rate at 0.4% (2024). Source: APRA, 2024

Defaults increased by 0.1% post-COVID recovery (2023–2024). Source: RBA, 2024

Broker-arranged loans have a 0.6% default rate vs. 0.8% for direct loans. Source: MFAA, 2025

Variable-rate loan defaults: 0.65% in 2024. Source: APRA, 2024

Fixed-rate loan defaults: 0.55% in 2024. Source: APRA, 2024

90% of defaults occur within the first 5 years of a loan. Source: RBA, 2024

First-Home Buyers

27% of home loans in 2024 were for first-home buyers. Source: ABS, 2024

First Home Guarantee scheme supported 35,000 buyers in 2023–2024. Source: NHFIC, 2024

72% of first-home buyers opt for variable-rate loans. Source: Canstar, 2024

Average first-home buyer deposit: 14% in 2024. Source: Domain, 2024

46% of first-home buyers use brokers for loan applications. Source: Finder, 2024

First-home buyer loans grew 12% from 2022 to 2024. Source: ABS, 2024

34% of first-home buyers qualify for LMI waivers via schemes. Source: NHFIC, 2024

Average first-home buyer loan term: 28 years in 2024. Source: APRA, 2024

77% of first-home buyers are under 40 years old. Source: CoreLogic, 2024

First-home buyer grants saved $7,000 on average in 2024. Source: Money.com.au, 2024

Professional Home Loans

88% of doctors qualify for LMI waivers up to 90% LVR. Source: Home Loan Experts, 2024

Engineers save $7,310 on LMI for a $500,000 loan with an 82% waiver. Source: Professional Home Loans, 2024

Lawyers with $120,000+ income qualify for 95% LVR loans. Source: Lendi, 2024

Nurses save $15,000 on LMI for an $800,000 loan at 90% LVR. Source: Professional Home Loans, 2024

73% of professional loans have rates below 5.8% in 2025. Source: RateCity, 2025

Accountants with 2+ years’ experience get no LMI up to 90% LVR. Source: Mortgage Choice, 2024

90% of professional loans are processed within 48 hours. Source: MFAA, 2025

Medical specialists borrow up to $5M with no LMI. Source: Professional Home Loans, 2024

65% of professional loans include overtime income in assessments. Source: Canstar, 2024

Psychologists save $10,000 on average with LMI waivers. Source: Professional Home Loans, 2024

Interest Rates and RBA Impact

RBA cash rate cut to 3.85% on May 20, 2025, reduced repayments by $76/month on a $500,000 loan. Source: Canstar, 2025

Average variable home loan rate: 5.81% in June 2025. Source: RBA, 2025

Fixed-rate loans average 5.6% for 3-year terms in 2025. Source: RateCity, 2025

60% of borrowers chose variable rates post-RBA cut. Source: Finder, 2025

Refinancing surged 15% after the May 2025 rate cut. Source: Savings.com.au, 2025

Average interest savings from refinancing: $2,500/year on a $400,000 loan. Source: Money.com.au, 2025

80% of new loans in 2025 are below 6% interest. Source: APRA, 2025

25% of borrowers locked in fixed rates before the RBA cut. Source: Canstar, 2025

Interest rate reductions saved $1,200/year on average for $300,000 loans. Source: RateCity, 2025

90% of brokers report increased inquiries post-RBA cut. Source: MFAA, 2025

Visa Holder Home Loans

491 visa holders can borrow up to 90% LVR with LMI. Source: Professional Home Loans, 2024

482 visa holders face 8% stamp duty surcharges in NSW and VIC. Source: Revenue NSW, 2024

85% of 491 visa loans are for new properties due to FIRB rules. Source: ATO, 2024

Average 482 visa loan size: $450,000 in 2024. Source: Lendi, 2024

60% of visa holder loans require 10% deposits. Source: Mortgage Choice, 2024

FIRB fees for visa holders: $14,100 for properties up to $1M. Source: ATO, 2024

78% of 485 visa loans are for first-home buyers. Source: Finder, 2024

820 visa holders qualify for 90% LVR with LMI. Source: Professional Home Loans, 2024

50% of visa holder loans are processed through brokers. Source: MFAA, 2025

491 visa loans grew 20% from 2023 to 2024. Source: Canstar, 2024

Regional and Rural Loans

Rural property loans average $450,000 in 2024. Source: RateCity, 2024

60% of rural loans require 20% deposits due to saleability risks. Source: CoreLogic, 2024

Vacant land loans up to 60 hectares qualify for 95% LVR. Source: Professional Home Loans, 2024

70% of rural loans are for lifestyle properties, not farms. Source: Domain, 2024

Rural loan defaults: 0.6% in 2024. Source: APRA, 2024

80% of vacant land loans require building plans within 12 months. Source: Money.com.au, 2024

Average rural loan term: 25 years in 2024. Source: ABS, 2024

65% of rural loans are variable-rate. Source: RBA, 2024

Rural loan approvals take 30% longer than urban loans. Source: MFAA, 2025

55% of rural borrowers use brokers for zoning expertise. Source: Canstar, 2024

General Market Trends

Home loan approvals increased 10% in 2024. Source: ABS, 2024

34% of loans in 2024 were for investment properties. Source: CoreLogic, 2024

Average loan term: 29 years in 2024. Source: APRA, 2024

64% of borrowers prefer online applications in 2025. Source: Finder, 2025

22% of loans include offset accounts in 2024. Source: Canstar, 2024

93% of borrowers compare at least 3 lenders via brokers. Source: Mortgage Choice, 2024

41% of loans in 2025 are under $400,000. Source: ABS, 2025

12% of borrowers use guarantor loans to avoid LMI. Source: NHFIC, 2024

73% of brokers offer free consultations in 2025. Source: MFAA, 2025

27% of loans are refinanced within 5 years. Source: RBA, 2024

82% of borrowers value broker expertise over bank convenience. Source: Savings.com.au, 2025

Take Action with Professional Home Loans

These statistics highlight the value of working with a mortgage broker to navigate Australia’s home loan market. Whether you’re seeking an LMI waiver, a low-rate loan, or regional financing, Professional Home Loans can help. Book a free consultation at to start the process to own your own home!