Home Loans for Veterinarians: Vet Mortgage Options

- For Vets who are Australian Citizens or Permanent Residents

- Borrow up to 95% of the purchase price

- Full Waiver of the Lenders Mortgage Insurance Premium

- Competitive interest rates

- No cost, no obligation service

At Professional Home Loans, we focus on getting veterinarians across Australia the best home loan deals. Whether you’re buying your first home, moving to a bigger place, or investing in property, we’ve got mortgage options that fit your life as a vet.

How Home Loans for Veterinians Work

As a veterinarian, you’re in a strong position to secure a mortgage with perks like no Lenders Mortgage Insurance (LMI), lower interest rates, and terms that work for you. These benefits make it easier to buy a home or invest, whether you’re a general practitioner, specialist, locum, or new grad.

What’s in It for Vets?

- Borrow with a 5% Deposit: Get a vet mortgage up to 95% of the property value without paying LMI, saving you thousands upfront.

- Lower Rates: We negotiate special interest rate discounts for vets, including AVA members.

- Flexible Options: Pick from simple home loans, professional packages, fixed or variable rates, or loans with offset accounts.

- Quick Approvals: Your stable income as a vet means faster approvals and higher borrowing limits.

How Much Can Vets Borrow?

Veterinarians can borrow up to 95% of a property’s value without LMI, and your profession’s earning power often means higher loan limits.

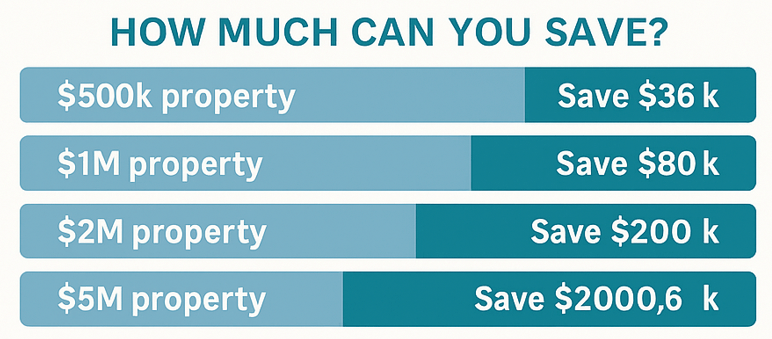

How Much You Can Save

By borrowing up to 95% LVR with LMI waived, you can save significantly:

What is the criteria for Veterinaries to waive LMI?

For Veterinary Practitioners to obtain waiver of the lenders mortgage insurance premium, they must be able to demonstrate:

- Member of the Australian Veterinary Association or Australian Veterinary Business Association (or able to obtain membership)

- Australian citizenship or permanent residency

- Proof of income (payslips, contracts, tax returns)

- Solid credit history

- Self-employed Vets are acceptable

- Deposit of 5% and funds to cover stamp duty and incidental costs

What if I do not meet this criteria?

If we do not believe you meet the above criteria, we may still be able to help. Whilst lenders mortgage insurance is required if you do not have a 20% deposit, we may still be able to assist with a home loan for strong applicants up to 85% with no lenders mortgage insurance premium payable.

Examples of how this policy could be used

Veterinarians could use this policy standalone to purchase a new home or investment property. Alternatively, they could refinance their current home loan into this offering and release equity for a purchase of another property.

What is the next step?

This offer is not available to the general mortgage broker market.

Further, all applications for LMI waiver by Veterinarians are considered on a case by case basis.

If you would like to find out if you qualify please give us a call on 1300 55 44 97 or book in for a 30 minute strategy session.

Free 30-Minute Finance Strategy Session For Professionals

Discover How To Get Approved With A Lower Interest Rate & Save Up To $40,000 In Fees

Frequently Asked Questions for Vets and Veterinarians

Can veterinarians and vets borrow more without paying LMI?

Yes, you can borrow up to 95% of the property value with LMI waived.

What documents are needed?

Payslips, tax returns, proof of veterinary registration, and identification documents.

Are investment loans available for vets?

Absolutely! We offer competitive investment loan options tailored for veterinary professionals.

How do I secure the best rates as a veterinarian or vet?

Work with our specialist brokers who negotiate exclusive rates and terms for vets and veterinarians.

Can I get pre-approval?

Yes! Pre-approvals are quick and help you understand your borrowing power before you start house hunting.

Getting a home loan was really simple with Professional Home Loans.

“We went overseas during settlement and it was not a problem for them, everything went smoothly and I’m writing this from my new home! “

Jack Clancy

Well done you made it easy with no BS.

“Couldn’t ask for a better job – until next time (although no time soon, moving was awful). “

Accountant, Mick and Vanessa Renton

No LMI for building home in Sydney as well as 90% LVR no lmi for investment proerpty off the plan in Newcastle.

“Professional Home Loans has provided us with a very professional service, communicating all the available options to us and in the process he has literally saved us $75k that we would have otherwise paid. They certainly go beyond the call of duty. “

Hamilton (Accountant) & Nyari (Doctor) Sydney

Working for QLD Health achieved 90% LVR no LMI at normal rates - From UK. Sunshine Coast, QLD

“We were able to get a loan at a good rate and avoid paying LMI which saved us several thousand dollars that we can now put towards other things. Very helpful and informative about all aspects of the process, not just the loan, which we really appreciated as it made the whole thing a lot easier for us.”

Craig and Louise (Medical Registrars)

On a contracting basis – she got paid roughly 70% of what she billed.

“We assisted Arlyn with a 90% Mortgage with No Lenders Mortgage Insurance payable so she could buy a house and land package Thanks so much. All credits goes back to you as you helped me make all this happen. I couldn’t thank you enough for the job excellently done. “