Refinance Home Loans for Professionals & Expats

Are you a professional, expat, or temporary visa holder aiming to enhance your home loan in Australia? Refinancing with Professional Home Loans provides access to competitive interest rates, tailored financial solutions, and significant savings, such as Lenders Mortgage Insurance (LMI) waivers for eligible professionals. Our experienced brokers specialize in guiding doctors, lawyers, accountants, expats, and temporary visa holders through a streamlined refinancing process to meet your financial goals.

Benefits of Refinancing Your Home Loan

Refinancing allows you to secure a loan that aligns with your financial priorities. Whether you seek lower repayments, access to equity, or simplified debt management, refinancing offers key advantages:

- Lower Interest Rates: Reduce your loan costs with a competitive rate, as tracked by the Reserve Bank of Australia [nofollow].

- LMI Waivers for Professionals: Eligible professionals, such as nurses, can benefit from LMI waivers, saving thousands.

- Solutions for Expats and Visa Holders: We partner with lenders offering flexible terms for expats and visa holders.

- Debt Consolidation: Combine multiple debts into one manageable home loan payment.

- Customized Loan Terms: Adjust your loan to support your financial strategy.

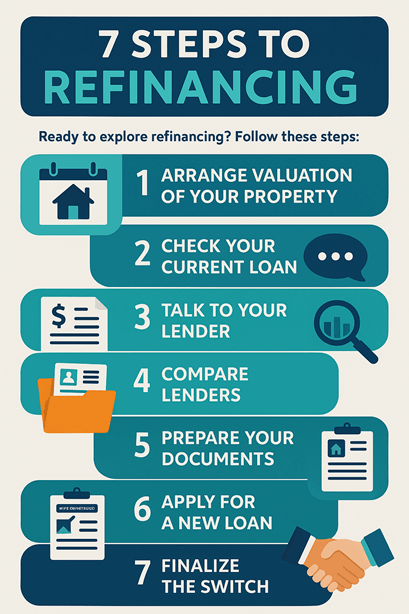

Ready to explore your options? Contact our expert brokers for a tailored consultation.

Understanding Refinancing Savings and Costs

Refinancing can deliver substantial savings, as illustrated in our infographic above. The graphic highlights potential savings, such as lowering your interest rate by 0.5% on a $500,000 loan, which could save approximately $1,500 annually over a 30-year term, according to data from Finder. It also breaks down costs, including exit fees ($0-$500), application fees ($0-$600), and valuation fees ($200-$300), using a pie chart to compare refinancing costs (e.g., fees) versus benefits (e.g., interest savings). Evaluate these using our loan calculator or explore more tools at our calculators hub to confirm refinancing benefits outweigh costs.

Benefits for Professionals

Professionals, including doctors, dentists, lawyers, and nurses, gain access to exclusive refinancing benefits through our network of over 30 lenders. These include:

- LMI Waivers: Borrow up to 90% of your property’s value without LMI, potentially saving $10,000 or more, as detailed on our nurses home loans page.

- Preferential Rates: Secure discounted rates reserved for high-income professionals.

- Tailored Loan Structures: Design a loan to match your career and financial aspirations.

Discover our expertise in serving professionals at About Us.

Refinancing Home Loans for Expats and Visa Holders

Australian expats and temporary visa holders, such as those on 482 or 457 visas, often face unique refinancing challenges. Our brokers simplify the process by connecting you with lenders who offer:

- Expat-Friendly Loans: Tailored solutions for Australians abroad—explore our expat home loans page.

- Visa Holder Options: Flexible terms for visa holders with limited credit history—learn more on our temporary visa home loans page.

- Efficient Documentation: Streamlined processes to reduce complexity.

For insights into visa holder financing, see Canstar’s guide.

Frequently Asked Questions About Refinancing

When Is the Right Time to Refinance?

You may refinance when better loan terms are available or your financial situation changes, typically after 12 months, though some lenders allow earlier.

What Are the Costs Involved?

Expect fees such as exit fees ($0-$500), application fees ($0-$600), and legal fees ($500-$1,000). These often pale compared to savings, as noted by Finder.

Can I Refinance with Poor Credit?

Yes, though options may be limited. We work with lenders who accommodate non-traditional credit profiles.

How Long Does Refinancing Take?

Typically 4-6 weeks, but our team aims for approvals in 2-3 weeks.

Why Choose Professional Home Loans?

Our team at Professional Home Loans is committed to delivering exceptional refinancing solutions. With access to over 30 lenders, we secure competitive rates and terms for professionals, expats, and visa holders. Our transparent approach ensures no hidden fees and clear communication. Learn more about our dedication at About Us.