Your Step-by-Step Home Loan Process with Professional Home Loans

Getting a home loan can seem complicated. But with Professional Home Loans, it doesn’t have to be. We make the process simple and fit it to your job, visa, and money goals. Here’s what to expect when you work with our expert team, from your first chat to getting your keys.

Step 1 - Strategy Session: Understand Your Goals

Your journey starts with a free, no-pressure chat about your plans. We will:

Talk about what you want to do (buy a home, refinance, or get money from your home’s value).

Understand your job or visa status to find special loan options for you.

Look at your income, estimated living costs, and any debts you have.

Give you a first plan that’s just for your situation.

Free 30-Minute Finance Strategy Session For Professionals

Discover How To Get Approved With A Lower Interest Rate & Save Up To $40,000 In Fees

Step 2 - Know What You Can Borrow

We carefully check how much money you can borrow and what savings you’ll need. This helps you clearly see your financial position. We will:

Look at your recent payslips to confirm your income.

Estimate your everyday living costs like groceries, childcare, and bills.

Find all your debts and ongoing payments.

Work out the smallest deposit you need (usually 5% to 20%).

Step 3 - Your Personalised Planning Report

An important step is getting your own detailed Planning Report. This report helps you make smart choices. It includes:

A clear breakdown of how your purchase or refinance will be funded, showing both the loan amount and your deposit.

Specific lender choices that fit your eligibility and job.

A side-by-side comparison of interest rates, fees, and features from different loan products.

Our expert advice on the best lender and loan product for you, including details on your expected loan repayments.

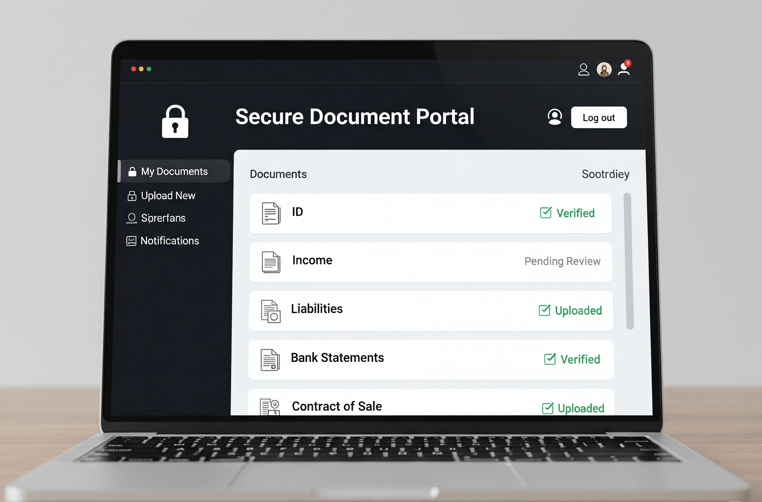

Step 4 - Gather & Upload Your Documents

Once you are happy with the recommendation in the Planning Report, we will email you a link to a secure portal. To make your application smooth, we’ll give you a clear list of documents to send us securely. This includes:

Identification (like your passport or visa).

Financial papers such as payslips, bank statements, and employment letters.

Signed fact-find and important compliance documents.

Access to our secure online portal for easy and private document uploads.

Step 5 - Submit Your Application for Lender Review

Once we have all your documents and have checked them, we take over. We will:

Carefully prepare and send your complete application to the lender you’ve chosen.

Talk directly with the lender for you and quickly answer any questions they have.

Keep an eye on your application’s status and regularly update you on its progress.

Step 6 - Get Pre-Approval & Start Your Property Search

Getting pre-approval for your home loan is an exciting step forward. This means:

You’ll have clear guidance on your budget based on the property price.

Your offers on properties will be stronger, showing you’re a serious buyer.

You can start looking for a house with confidence and a clear idea of what you can afford.

Step 7 - Find Property, Proceed to Formal Approval

Once a seller accepts your offer on a property, we move to get your final approval:

The bank officially sends out your formal approval letter.

All loan terms are set with no more conditions, giving you certainty.

We quickly tell your real estate agent that your offer is now unconditional.

Step 8 - Review & Sign Your Loan Documents

Next, you’ll get your important loan papers, and we’ll help you understand them. This includes:

Your loan contract, mortgage documents, and forms to set up direct debit payments.

A clear explanation of all the terms and how your repayments will work.

Full support to make sure everything is signed and completed correctly.

Step 9 - Prepare for Settlement

With your documents signed, we work closely with the bank to make sure settlement goes smoothly. We will:

Get all necessary documents certified.

Finalise the transfer of the property title and arrange all money movements.

Make sure everything is perfectly ready for the day you settle.

Step 10 - Settlement & Move Into Your New Home

Congratulations! This is the moment your loan officially settles, and you get your keys.

The property is now legally yours!

Move in with peace of mind, knowing your financial journey is complete.

Don’t worry, we’re still here to help with ongoing support even after you settle.

Why Work With Us?

With over 10 years of experience, we focus on helping Australian professionals and visa holders get the right loan. Our tailored process, expert knowledge, and quick-to-respond team are here to help you achieve the best outcome for your home loan needs.

Free 30-Minute Finance Strategy Session For Professionals

Ready to Start? Book a free chat today and take the first step towards owning your new home.

FREE REPORT

Get instant access to the free report: “The Professional’s Guide to Financing Australian Property”

- We respect your privacy

Home Loan Resources For Professionals

- Home Loans For Medical Professionals

- Home Loans For Legal Professionals

- Home Loans For Accounting & Finance Professionals

- Home Loans For Engineering & Mining Professionals

- For Veterinary Practitioners

- For Other Professionals

- Enquire Now

- Professional Home Loans Blog

- Business Loan Application

- Business Loans

- Add Your Testimonial

- Home Loan for Psychologists

Getting a home loan was really simple with Professional Home Loans.

“We went overseas during settlement and it was not a problem for them, everything went smoothly and I’m writing this from my new home! “

Jack Clancy

Well done you made it easy with no BS.

“Couldn’t ask for a better job – until next time (although no time soon, moving was awful). “

Accountant, Mick and Vanessa Renton

No LMI for building home in Sydney as well as 90% LVR no lmi for investment proerpty off the plan in Newcastle.

“Professional Home Loans has provided us with a very professional service, communicating all the available options to us and in the process he has literally saved us $75k that we would have otherwise paid. They certainly go beyond the call of duty. “

Hamilton (Accountant) & Nyari (Doctor) Sydney

Working for QLD Health achieved 90% LVR no LMI at normal rates - From UK. Sunshine Coast, QLD

“We were able to get a loan at a good rate and avoid paying LMI which saved us several thousand dollars that we can now put towards other things. Very helpful and informative about all aspects of the process, not just the loan, which we really appreciated as it made the whole thing a lot easier for us.”

Craig and Louise (Medical Registrars)

On a contracting basis – she got paid roughly 70% of what she billed.

“We assisted Arlyn with a 90% Mortgage with No Lenders Mortgage Insurance payable so she could buy a house and land package Thanks so much. All credits goes back to you as you helped me make all this happen. I couldn’t thank you enough for the job excellently done. “