Are you planning to buy a home with less than a 20% deposit? If so, you’ve likely come across LMI, or Lenders Mortgage Insurance. But what does it mean for you, how much might it cost, and are there ways to avoid it? In this guide, I’ll walk you through everything you need to know about LMI, with a special focus on options for professionals entering the property market in 2025.

What is LMI on a Home Loan?

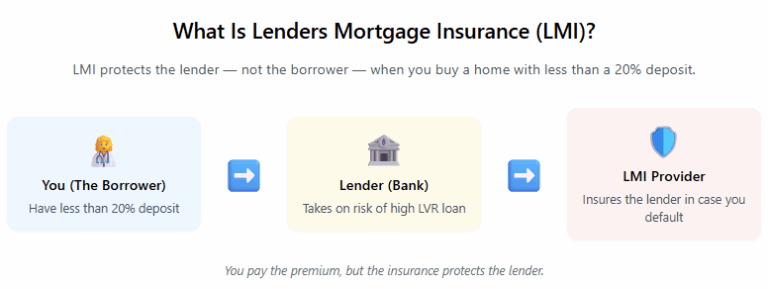

LMI, or Lenders Mortgage Insurance, is a one-time fee that lenders charge when you borrow more than 80% of a property’s value. This insurance protects the lender, not you, in case you can’t repay the loan and the property sells for less than the outstanding amount. It’s a common requirement if you’re putting down a deposit of less than 20%.

For instance, if you’re borrowing 90% of the property’s value, LMI is typically mandatory unless you qualify for an exemption. Some lenders, however, offer “90% no LMI” home loans, particularly for professionals in fields like medicine or engineering. This fee is usually rolled into your loan amount, though some prefer to pay it upfront at settlement.

How Much Does LMI Cost?

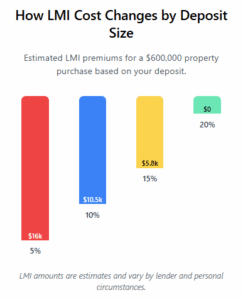

The cost of LMI varies based on your deposit size, loan amount, and the lender’s specific policy. As a rough estimate, for a $500,000 loan with a 10% deposit, LMI could range from $8,000 to $12,000. Larger loans or smaller deposits will push the cost higher.

Many lenders provide online LMI calculators to give you a ballpark figure. Alternatively, feel free to reach out to us at Professional Home Loans, and we’ll provide a personalized estimate based on your circumstances. For a detailed tool, you can also check the Westpac’s LMI calculator.

Is LMI Worth Paying?

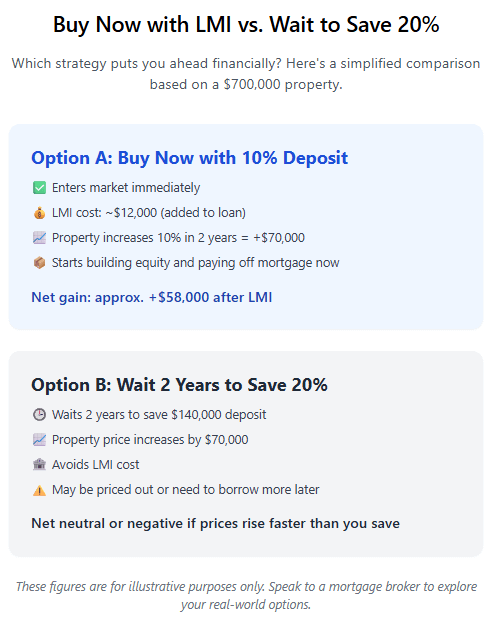

Paying LMI can be a smart strategy depending on your goals. If waiting to save a 20% deposit means missing out on a rising market, the cost might be justified. For example, a $10,000 LMI fee today could pale in comparison to $40,000 in property value growth over the next year.

While it’s not ideal that LMI benefits the lender rather than you, it can open the door to homeownership sooner. If you qualify for an LMI waiver, that’s the ideal scenario. Otherwise, weighing the long-term gains against the upfront cost can make it a worthwhile investment. Learn more about how professionals can benefit from these options on our Home Loans for Professionals page.

How to Avoid or Reduce LMI

LMI is often unavoidable with deposits below 20%, but there are practical ways to minimize or eliminate it. Here are some options to explore:

Ways to Avoid LMI:

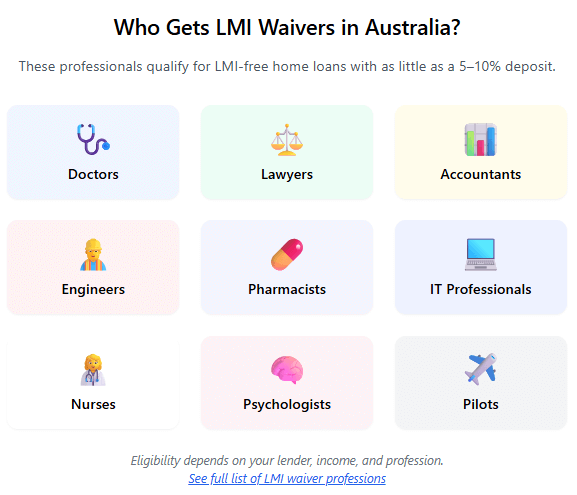

LMI Waivers for Professionals: Banks often waive LMI for doctors, lawyers, accountants, engineers, pilots, nurses and similar professionals, even with deposits as low as 5% or 10%. For example, Commonwealth Bank has programs for eligible high-income applicants.

Guarantor Loans: A family member can use their property as extra security to cover the LMI requirement.

Government Schemes: First Home Guarantee lets first-time buyers purchase with a 5% deposit without LMI, a great option in today’s market.

If you’re unsure about your eligibility, we offer a free assessment to check if you qualify for an LMI waiver. Check out our guide on who else gets LMI waivers in 2025 for more details.

Can LMI Be Refunded or Waived?

Generally, LMI isn’t refundable once paid. However, some lenders may offer partial refunds if you refinance or pay off your loan within the first two years, though policies differ. It’s worth asking about this upfront.

On a brighter note, LMI can often be waived entirely if you meet certain criteria, such as being a high-income professional or working in a qualifying industry. At Professional Home Loans, we partner with lenders who provide waivers for loans up to 90% or even 95% of the property value, especially with the recent RBA rate cut to 3.85% making borrowing more attractive.

Is LMI Tax Deductible?

LMI isn’t tax deductible if you’re buying a home to live in. However, if you’re investing in a property, you may be able to claim the LMI cost as a tax deduction spread over five years. Consult your accountant for advice tailored to your financial situation, especially with 2025 tax changes on the horizon. For official guidance, visit the Australian Taxation Office deductions page.

Final Thoughts

LMI doesn’t have to stand in your way. In a market where property prices are climbing, it can be a stepping stone to owning your home sooner, particularly with the RBA’s recent rate adjustment. For professionals, the chance to avoid LMI altogether is a real possibility.

At Professional Home Loans, we specialize in helping professionals across Australia secure home loans with minimal or no LMI, even with deposits under 20%. Let’s find the right solution for you.

Ready to Buy with Less Than a 20% Deposit?

If you’re a doctor, lawyer, engineer, accountant, or another professional, you could qualify for an LMI waiver and save thousands. Book a free consultation with us today.

Our team will guide you through the process and connect you with lenders offering the best deals for your profession, especially in light of current market conditions.

Additional Resources: