Nurses, paramedics, teachers, and firefighters are the backbone of our communities. Recognising their invaluable contributions, many lenders now offer home loans for nurses and essential workers with tailored benefits to make homeownership more accessible. These advantages can significantly reduce costs and lower the barriers to entering the property market.

Benefits of Home Loans for Nurses and Essential Workers

Lenders Mortgage Insurance (LMI) Waivers

Typically, buyers with less than a 20% deposit are required to pay LMI, which can range from $5,000 to $20,000. However, several lenders offer home loans for nurses and essential workers with LMI waivers, allowing you to purchase a home with as little as a 5% deposit without the added insurance cost.

Eligibility Criteria:

Registered nurses, midwives, paramedics, and sometimes aged care workers

Minimum of 12 months of stable employment

Annual income meeting specific lender thresholds

Example: A nurse earning $80,000 annually could purchase a $500,000 property with a $25,000 deposit, avoiding a $15,000 LMI fee.

For more details on LMI waivers, visit our LMI Waivers 2025: Professions That Save on Home Loans page.

Low Deposit Home Loans

Beyond LMI waivers, some lenders offer home loans for nurses and essential workers with low deposit options. These loans can require as little as a 5% deposit, making it easier to enter the property market sooner.

Benefits:

Reduced upfront costs

Faster path to homeownership

Access to competitive interest rates

Eligibility Criteria

Eligibility for home loans for nurses and essential workers can vary between lenders, but common requirements include:

Employment in an eligible profession (e.g., nursing, teaching, emergency services)

Minimum of 12 months in your current role

Australian citizenship or permanent residency

Meeting specific income thresholds

It’s essential to consult with a mortgage broker or lender to understand the specific criteria applicable to your situation.

Government Grants and Assistance Programs

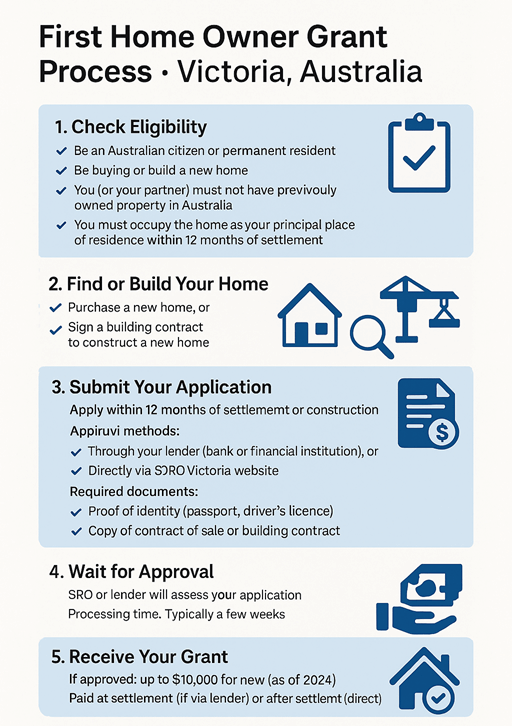

First Home Owner Grant (FHOG)

In Victoria, eligible first-home buyers can receive a $10,000 grant when purchasing or building a new home valued up to $750,000. This grant can significantly reduce the financial burden of entering the property market with home loans for nurses and essential workers.

Key Points:

Applicable for new homes only

Property value must not exceed $750,000

Applicants must be Australian citizens or permanent residents

For more information, visit the State Revenue Office of Victoria.

First Home Guarantee (FHBG)

The FHBG is part of the Australian Government’s Home Guarantee Scheme, assisting eligible first-home buyers in purchasing a home with a deposit as low as 5%, without paying LMI. This makes it even easier for essential workers to access home loans for nurses and essential workers.

Highlights:

Available to 35,000 applicants annually

Applicable for both new and existing homes

Income and property price caps apply

Learn more about the FHBG on the Housing Australia website.

How to Apply

Assess Your Eligibility: Determine if you meet the criteria for home loans for nurses and essential workers, as well as any government grants.

Gather Documentation: Prepare necessary documents such as proof of employment, income statements, and identification.

Consult a Mortgage Broker: Engage with professionals who can guide you through the application process and connect you with suitable lenders.

Submit Applications: Apply for the chosen home loan and any applicable grants or schemes.

Finalise the Purchase: Once approved, proceed with the property purchase and settlement process.

For personalized assistance, contact our team at Professional Home Loans.

By leveraging home loans for nurses and essential workers and government initiatives, you can take significant steps toward achieving your homeownership dreams. For expert guidance and support throughout the process, reach out to our team at Professional Home Loans.